Revolutionizing International Banking

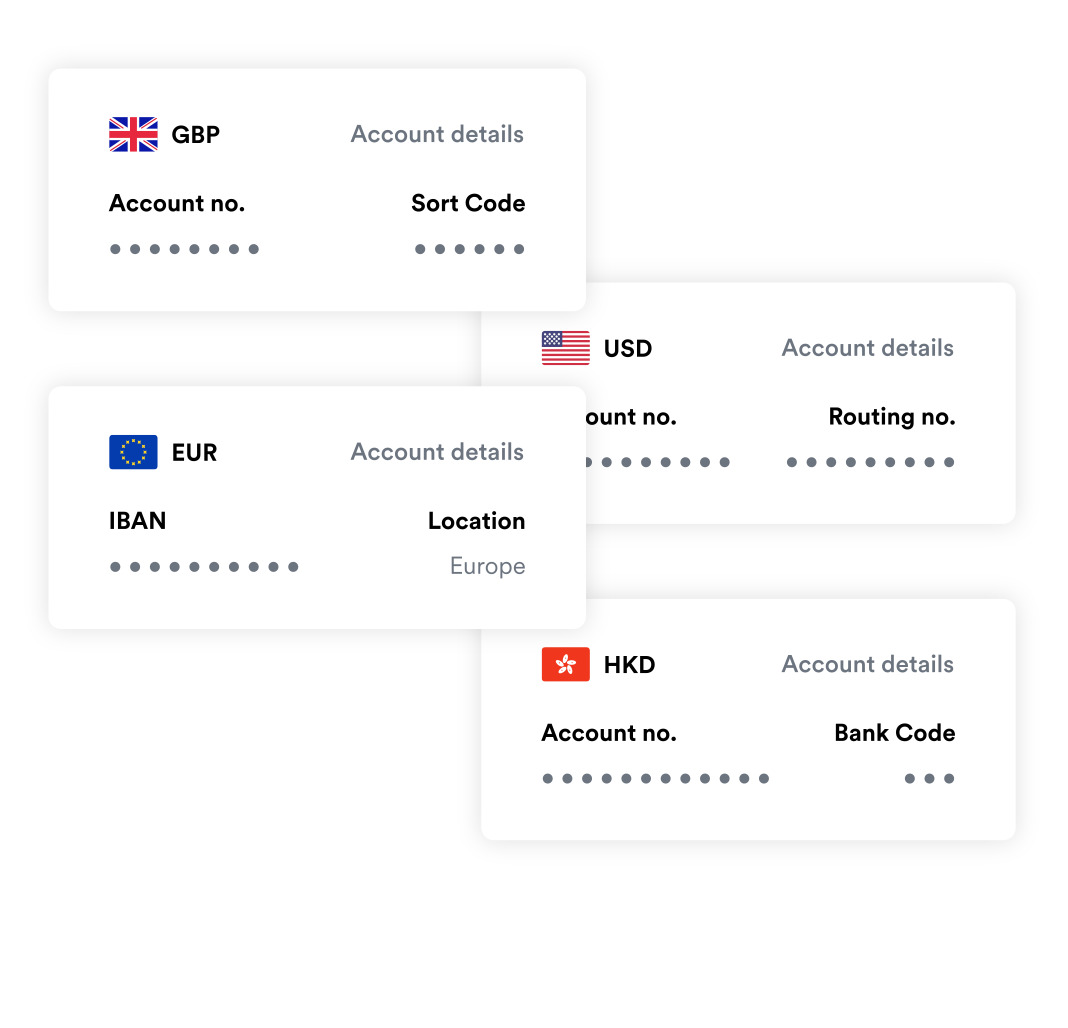

Open foreign currency account online to manage your international finances. All you need is your national ID.

-

ReceiveCollect international payments from global customers in their preferred currency.

-

HoldBenefit from holding funds in a foreign currency until FX rates are favourable enough to convert these funds to your home currency.

-

SpendSpend proceeds later in the same currency using virtual or physical debit card, eliminating unnecessary conversion fees.

-

TransferSend money to Indian accounts (including UPI) at best exchange rates on the internet.

-

InvestInvest in US assets through US brokers by conveniently connecting your USD account.